Budget challenges facing Bowman County Schools mirror those of most government entities this year, with the loss of taxable valuation, increase in expenses, declining amount of state aid and uncertainty in local sources of revenue.

By BRYCE MARTIN

Pioneer Editor | [email protected]

Budget challenges facing Bowman County Schools mirror those of most government entities this year, with the loss of taxable valuation, increase in expenses, declining amount of state aid and uncertainty in local sources of revenue.

It was for those reasons that the school, just like the county and parks and recreation department, was forced to add to the tax burden, averaging less than $4 a month per property.

It is the first time in over 10 years that Bowman County has lost value of its mill, according to Bowman County Superintendent Dave Mahon, who joined the Bowman County School Board to discuss the budget prior to its consideration for approval Oct. 3.

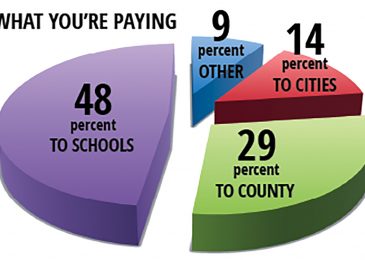

The county’s two school districts represent nearly half of a property owner’s annual tax, with the county at 29 percent, the cities at 14 percent and miscellaneous taxes at 9 percent.

Like the county, the school relies on centrally assessed taxable value to determine in mill levy. Since those values decreased, on items such as pipelines, wind turbines and railroads, so did the overall taxable valuation.

This year’s budget will be less than last year’s with the loss of 18 students.

“It’ll be a challenge to make that up,” Mahon said.

He affirmed that the school would not cut teachers since the “school needs a certified staff.”

If the school were to run its 2017 budget on the devalued mill rate it would see a loss of $94,000.

Its plan to increase its mill, however, would translate into a minimal addition to the annual tax bills.

“We are going up as little as we could,” Mahon said. “I think we have a good balance with what we want to do with the budget.”